SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

SCHEDULE 14A INFORMATION | ||||||

| Proxy Statement Pursuant to Section 14(a) of the | ||||||

| Securities Exchange Act of 1934 | ||||||

| (Amendment No. ) | ||||||

Filed by the Registrant x | Filed by a Party other than the Registrant ¨ | |||||

| Check the appropriate box: | ||||||

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| x | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material Pursuant to § 240.14a-11(c) or § 240.14a-12 | |

Payment of Filing Fee (Check the appropriate box):

| Payment of Filing Fee (Check the appropriate box): | ||||

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-1 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

3355 Las Vegas Boulevard South, Las Vegas, Nevada 89109.

3, 2019.

Yours sincerely,

SHELDON G. ADELSON

Chairman of the Board

and Chief Executive Officer

April 22, 2016

| Yours sincerely, | |

| |

SHELDON G. ADELSON Chairman of the Board and Chief Executive Officer | |

June

2019

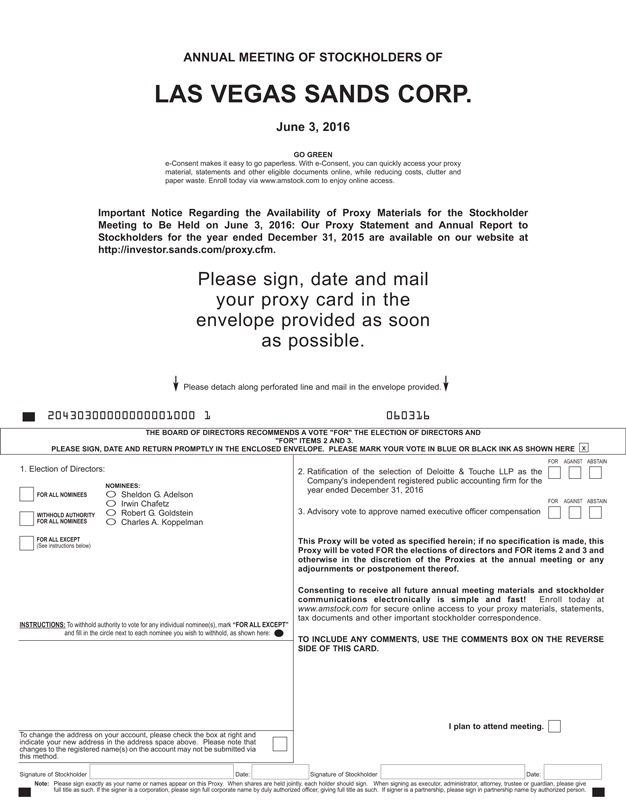

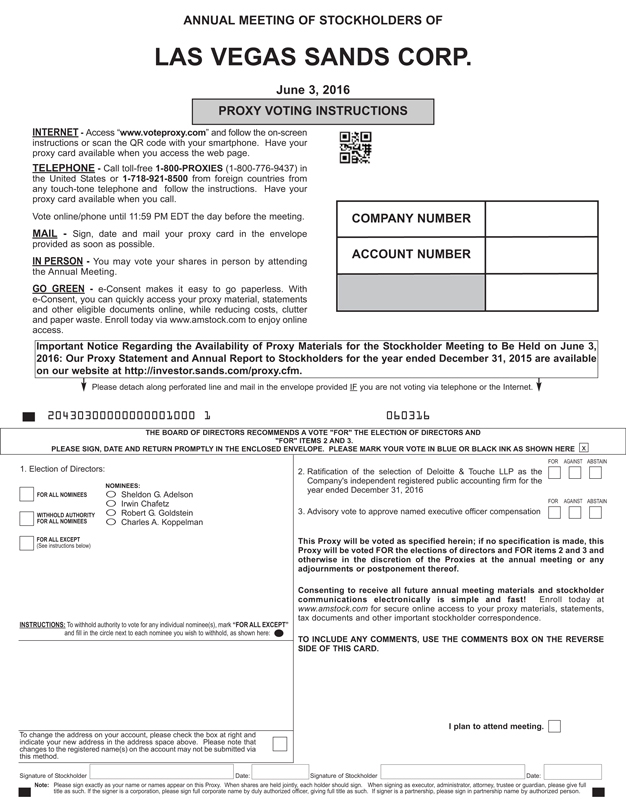

1. to elect four directors to the Board of Directors, each for a three-year term;

2. to consider and act upon the ratification of the selection of our independent registered public accounting firm;

3. to consider and act upon an advisory (non-binding) proposal on the compensation of the named executive officers; and

4. to transact such other business as may properly come before the meeting or any adjournments thereof.

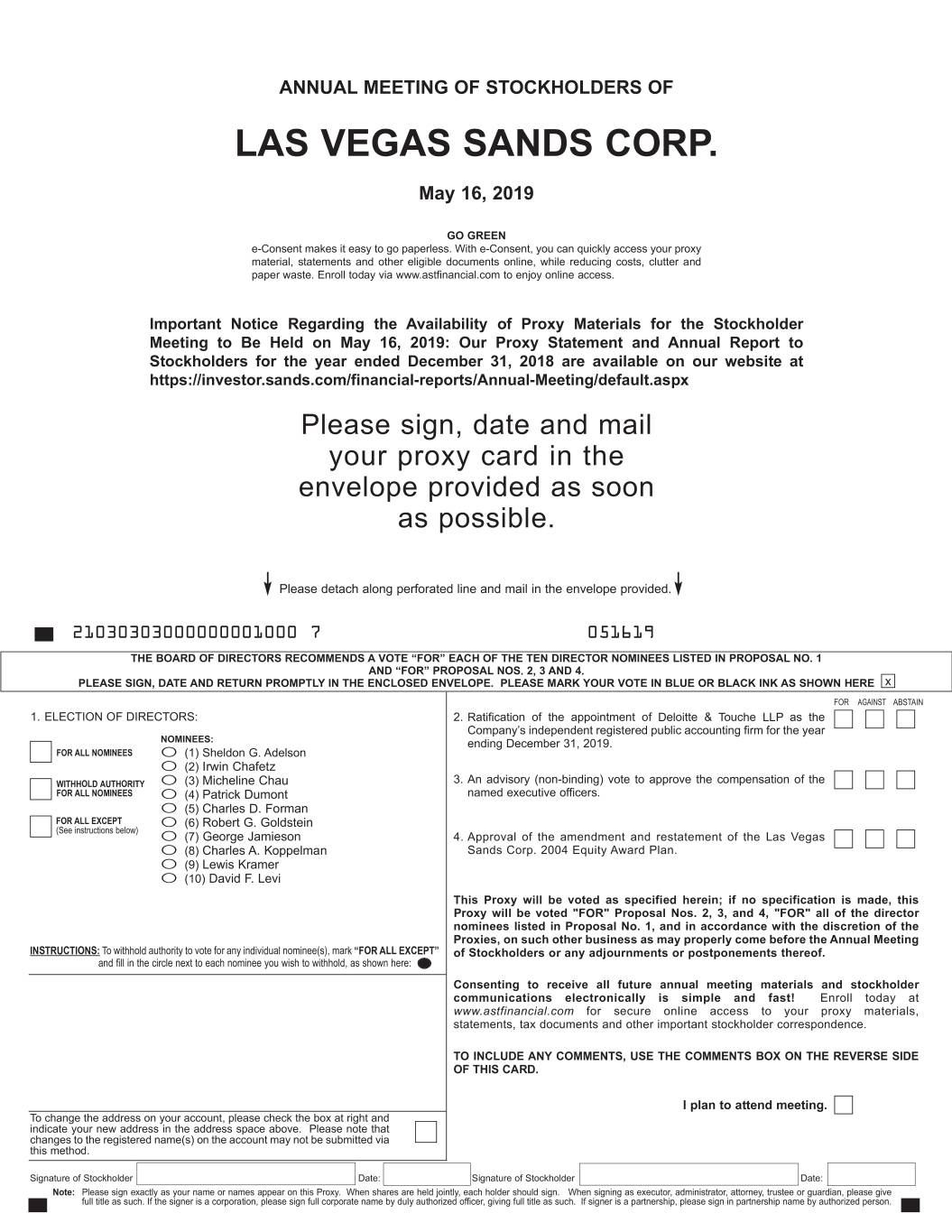

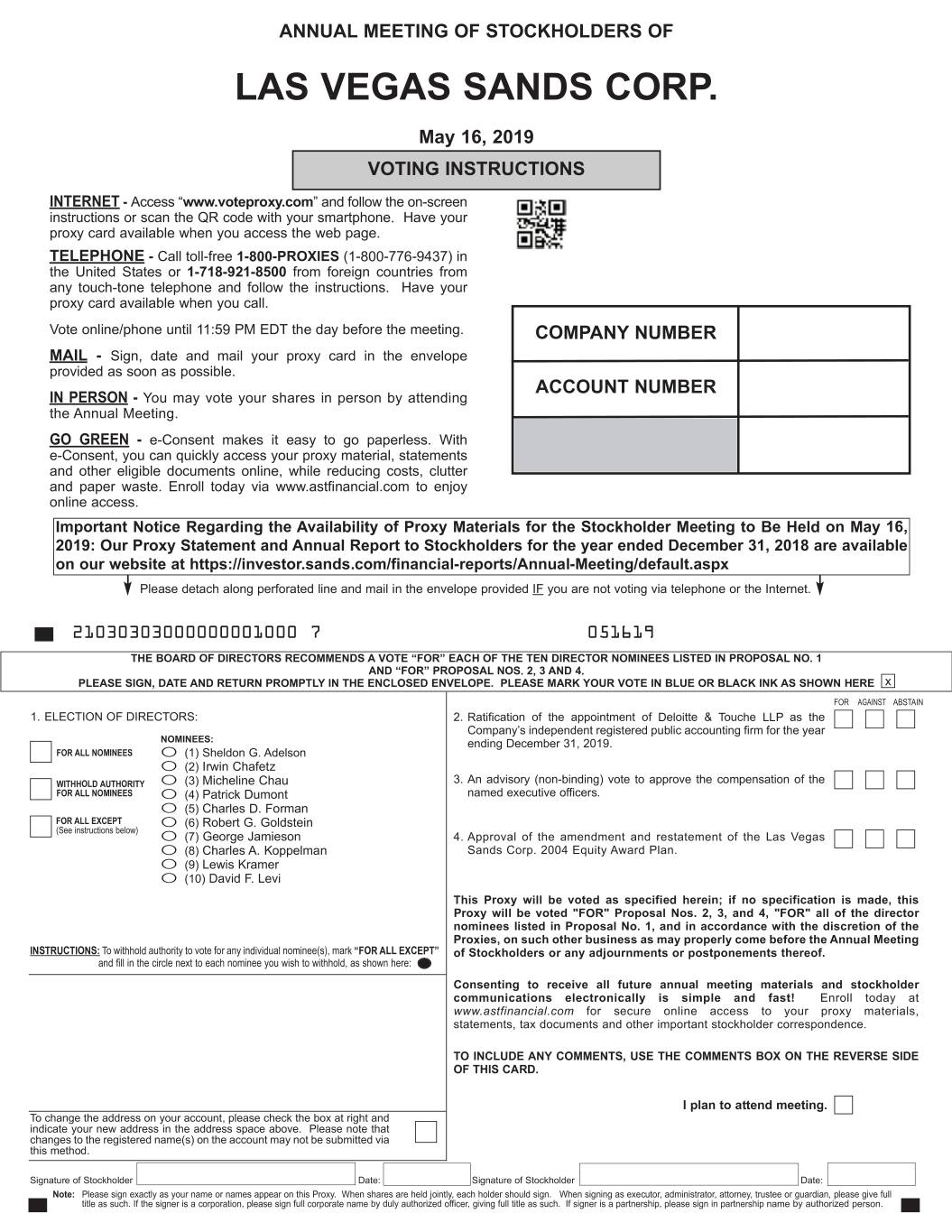

| 1. | to elect ten directors to the Board of Directors to serve until the 2020 Annual Meeting; |

| 2. | to ratify the appointment of our independent registered public accounting firm; |

| 3. | to vote on an advisory (non-binding) proposal to approve the compensation of the named executive officers; |

| 4. | to approve the amendment and restatement of the Company’s 2004 Equity Award Plan; and |

| 5. | to transact such other business as may properly come before the meeting or any adjournments or postponements thereof. |

By Order of the Board of Directors,

IRA H. RAPHAELSON

Executive Vice President, Global General Counsel

and Secretary

April 22, 2016

| By Order of the Board of Directors, | |

| |

Lawrence A. Jacobs Executive Vice President, Global General Counsel and Secretary | |

| Page | ||||

3, 2019.

The

If you duly submit a proxy but do not specify how you want to vote, your shares will be voted as our Board recommends, which is:

| |||||

| If you duly submit a proxy but do not specify how you want to vote, your shares will be voted as our Board recommends, which is: | |||||

| • “FOR” the election of each of the nominees for director as set forth under Proposal No. 1 below; | |||||

| • |

| |||||||

| • |

| ||||||

| • “FOR” the approval of the amendment and restatement of the Company’s 2004 Equity Award Plan as described in Proposal No. 4 below. | |||||||

by notifying the Corporate Secretary of the revocation or change in writing; by delivering to the Corporate Secretary a later dated proxy; or by voting in person at the annual meeting. each person known to us to be the beneficial owner, in an individual capacity or as a member of a “group,” of more than 5% of our Common Stock; each named executive officer; each of our directors; and all of our executive officers and directors, taken together. Name of Beneficial Owner(2) Sheldon G. Adelson(3)(4) Dr. Miriam Adelson(3)(5) Timothy D. Stein(3)(6) General Trust under the Sheldon G. Adelson 2007 Remainder Trust(3)(7) General Trust under the Sheldon G. Adelson 2007 Friends and Family Trust(3)(8) Robert G. Goldstein(9) Ira H. Raphaelson(10) Patrick Dumont(11) George M. Markantonis(12) George Tanasijevich(13) Jason N. Ader(14) Irwin Chafetz(3)(15) Micheline Chau(16) Charles D. Forman(17) Steven L. Gerard(18) George Jamieson(19) Charles A. Koppelman(20) David F. Levi(21) All current executive officers and current directors of our Company, taken together (14 persons)(22) * Less than 1%. A person is deemed to be a “beneficial owner” of a security if that person has or shares voting power, which includes the power to vote or direct the voting of such security, or investment power, which includes the power to dispose of or to direct the disposition of such security. A person is also deemed to be a beneficial owner of any securities of which that person has a right to acquire beneficial ownership within 60 days. Securities that can be so acquired are deemed to be outstanding for purposes of computing such person’s ownership percentage, but not for purposes of computing any other person’s percentage. Under these rules, more than one person may be deemed a beneficial owner of the same securities and a person may be deemed to be a beneficial owner of such securities as to which such person has no economic interest. Except as otherwise indicated in these footnotes, each of the beneficial owners has, to our knowledge, the sole voting and investment power with respect to the indicated shares of Common Stock. Percentages are based on How to Revoke or Change Your VoteYou may revoke or change your proxy at any time before it is exercised in any of three ways:You will not revoke a proxy merely by attending the annual meeting. To revoke or change a proxy, you must take one of the actions described above.If you hold your shares in a brokerage or other account, you may submit new voting instructions by contacting your broker, bank or nominee.Any revocation of a proxy, or a new proxy bearing a later date, should be sent to the following address: Corporate Secretary, Las Vegas Sands Corp., 3355 Las Vegas Sands Boulevard South, Las Vegas, Nevada 89109. To revoke a proxy previously submitted by telephone, Internet or mail, simply submit a new proxy at a later date before the taking of the vote at the annual meeting, in which case, the later submitted proxy will be recorded and the earlier proxy will be revoked.If you hold your shares in a brokerage or other account, you may submit new voting instructions by contacting your broker, bank or other nominee.Other Matters to be Acted upon at the MeetingOur Board presently is not aware of any matters other than those specifically stated in the Notice of Annual Meeting that are to be presented for action at the annual meeting. If any matter other than those described in this Proxy2Statement is presented at the annual meeting on which a vote may properly be taken, the shares represented by proxies will be voted in accordance with the judgment of the person or persons voting those shares.Adjournments and PostponementsAny action on the items of business described above may be considered at the annual meeting at the time and on the date specified above or at any time and date to which the annual meeting may be properly adjourned or postponed.Electronic Delivery of Proxy Materials and Annual ReportThe Notice of Annual Meeting and Proxy Statement and the Company’s 2015 Annual Report are available athttp://investor.sands.com/proxy.cfm. These materials are also available on the Investor Relations page of our website,http://investor.sands.com. In the future, for stockholders who have not already opted to do so, instead of receiving copies of the Notice of Annual Meeting and Proxy Statement and annual report in the mail, stockholders may elect to view proxy materials for the annual meeting on the Internet or receive proxy materials for the annual meeting by e-mail. The Notice will provide you with instructions regarding how to view our proxy materials for the annual meeting on the Internet and how to instruct us to send future proxy materials to you electronically by e-mail. Receiving your proxy materials online saves the Company the cost of producing and mailing documents to your home or business and gives you an automatic link to the proxy voting site.Stockholders of Record. If your shares are registered in your own name, to enroll in the electronic delivery service go directly to the website of our transfer agent, American Stock Transfer & Trust Company, https://www.amstock.comat any time and follow the instructions.Beneficial Stockholders. If your shares are not registered in your name, check the information provided to you by your bank or broker to enroll in the electronic delivery service, or contact your bank or broker for information on electronic delivery service.Delivery of One Notice or Proxy Statement and Annual Report to a Single Household to Reduce Duplicate MailingsIn connection with the Company’s annual meeting of stockholders, the Company is required to send to each stockholder of record a Notice or a Proxy Statement and annual report and to arrange for a Notice or a Proxy Statement and annual report to be sent to each beneficial stockholder whose shares are held by or in the name of a broker, bank trust or other nominee. Because many stockholders hold shares of Common Stock in multiple accounts, this process would result in duplicate mailings of Notices or Proxy Statements and annual reports to stockholders who share the same address. To avoid this duplication, unless the Company receives instructions to the contrary from one or more of the stockholders sharing a mailing address, only one Notice or Proxy Statement and annual report will be sent to each address. Stockholders may, on their own initiative, avoid receiving duplicate mailings and save the Company the cost of producing and mailing duplicate documents as follows:Stockholders of Record.If your shares are registered in your own name and you are interested in consenting to the delivery of a single Notice or Proxy Statement and annual report, toyou may enroll in the electronic delivery service goby going directly to the website of our transfer agent’s websiteagent, American Stock Transfer & Trust Company, at https://www.amstock.comwww.astfinancial.com anytime and followfollowing the instructions.Beneficial Stockholders.If your shares are not registered in your own name, your broker, bank trust or other nominee that holds your shares may have asked you to consent to the delivery of a single Notice or Proxy Statement and annual report if there are other Las Vegas Sands Corp. stockholders who share an address with you. If you currently receive more than one Notice or Proxy Statement and annual report at your household and would like to receive only one copy of each in the future, you should contact your nominee.Right to Request Separate Copies.If you consent to the delivery of a single Notice or Proxy Statement and annual report, but later decide that you would prefer to receive a separate copy of the Notice or Proxy Statement and annual report, as applicable, for each stockholder sharing your address, then please notify us or your nominee, as applicable, and we or they will promptly deliver such additional Notices or Proxy Statements and annual reports. If you wish to receive a separate copy of the Notice or Proxy Statement and annual report for each stockholder sharing your address in the future, you may contact our transfer agent, American Stock Transfer & Trust Company, directly by telephone at 1-800-937-5449 or by visiting its website athttps://www.amstock.comwww.astfinancial.com and following the instructions.Important Notice about SecurityAll meeting attendees may be asked to present a valid, government-issued photo identification (federal, state or local), such as a driver’s license or passport, and proof of beneficial ownership if you hold your shares through a broker, bank or other nominee before entering the meeting. Attendees may be subject to security inspections. Video and audio recording devices and other electronic devices will not be permitted at the meeting.3SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENTThe following table sets forth information as of April 12, 2016March 18, 2019, as to the beneficial ownership of our Common Stock, in each case, by: Beneficial Ownership(1) Shares Percent (%) 78,658,227 9.9 % 328,498,913 41.3 5,829,231 * 87,718,919 11.0 87,718,918 11.0 616,311 * 24,417 * 30,000 * 4,485 * 197,654 * 72,006 * 249,470,932 31.4 3,061 * 214,801 * 3,685 * 4,296 * 8,094 * 3,438 * 79,921,897 10.1 % Beneficial Ownership(1) Name of Beneficial Owner(2) Shares Percent (%) Sheldon G. Adelson(3)(4)79,239,380 10.3 % Dr. Miriam Adelson(3)(5)330,160,726 42.7 General Trust under the Sheldon G. Adelson 2007 Remainder Trust(3)(6)87,718,919 11.4 General Trust under the Sheldon G. Adelson 2007 Friends and Family Trust(3)(7)87,718,918 11.4 Robert G. Goldstein(8)1,387,057 * Patrick Dumont(9)275,000 * Lawrence A. Jacobs — * Irwin Chafetz(3)(10)255,835,078 33.1 Micheline Chau(11)11,763 * Charles D. Forman(12)208,274 * Steven L. Gerard(13)11,260 * George Jamieson(14)11,763 * Charles A. Koppelman(15)13,653 * Lewis Kramer(16)7,094 * David F. Levi(17)13,269 * All current executive officers and current directors of our Company, taken together (12 persons)(18)81,254,908 10.5 % ____________________(1)794,718,776772,804,476 shares issued and outstanding at the close of business on April 12, 2016March 18, 2019 (including unvested shares of restricted stock, but excluding treasury shares), plus any shares of our Common Stock underlying options held by all individuals listed onin the table that are vested and exercisable.

(2) |

|

(3) | Sheldon G. Adelson, Dr. Miriam Adelson, |

(4) | This amount includes (a) |

(5) | This amount includes (a) 93,779,145 shares of our Common Stock held by Dr. Adelson, (b) |

(6) |

|

This amount includes 87,718,919 shares of our Common Stock held by the General Trust under the Sheldon G. Adelson 2007 Remainder Trust. |

This amount includes 87,718,918 shares of our Common Stock held by the General Trust under the Sheldon G. Adelson 2007 Friends and Family Trust. |

This amount includes (a) |

This amount includes |

|

|

|

This amount includes (a) |

|

This amount includes (a) |

This amount includes (a) |

This amount includes (a) |

This amount |

This amount includes (a) |

(16) | This amount includes (a) 1,547 shares of our Common Stock held by Mr. Kramer, (b) 1,287 unvested shares of restricted stock vesting within 60 days of March 18, 2019, and (c) options to purchase |

This amount includes (a) |

This amount includes |